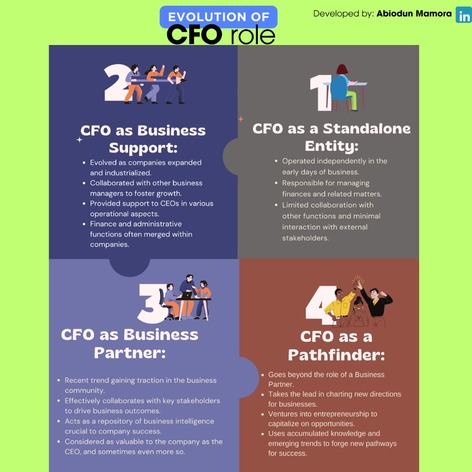

In today’s competitive and complex economic environment, a Pathfinder CFO is essential to unlock value and drive growth. Our services empower CFOs to navigate challenges, enhance performance, and deliver results,

We provide support to PE portfolio companies by uncovering opportunities for value maximization with special focus on growing the top line while minimizing costs.

| Pre acquisition | Value optimisation | |

|---|---|---|

| We empower clients to navigate the complexities of pre-acquisition risks and value creation with tailored strategies that unlock transformative growth in emerging markets. Leveraging strategic foresight, deep local expertise, and rigorous risk management, our advisors deliver actionable insights to drive confident investment decisions and sustainable returns. | Following an acquisition, we drive swift value creation by crafting strategic roadmaps for acquired entities, facilitating executive workshops to align leadership with key priorities, and spearheading targeted initiatives for measurable impact. |

We guide clients in developing an integrated media strategy for product launches, new market entry, and culture change campaigns. This strategy details how brands leverage diverse channels and platforms to meet precise marketing and communication goals, ensuring the right message reaches the right audience with maximum impact.

Operational efficiency is the cornerstone of profitability. We partner with you to assess and enhance every facet of your business—from sourcing inputs to managing supply chains, production, and distribution—ensuring your offerings consistently meet customer demands. Beyond operations, we scrutinize your revenue streams to unlock growth opportunities and maximize value. Our approach is collaborative: we pinpoint performance improvements and align our success with yours.

Infrastructure/Project Finance support

Infrastructure projects deliver substantial short and long-term value. Our team brings an outside-in perspective, conducting rigorous assessments to unlock revenue growth and optimize investment performance for all stakeholders. Through this approach, we aim to reduce risks, enhance quality, accelerate capital deployment, and boost economic progress in the markets we serve.

Operational Efficiency

We assess your operations, pinpoint inefficiencies, and propose solutions to cut waste, remove redundancies, and optimize processes—unlocking cost leadership and elevating product quality.

We help clients make their businesses more sustainable and responsible by focusing on environmental, social, and governance (ESG) goals. Using our expertise and clear insights, we guide them to measure progress, create practical ESG plans, reduce risks, and find new ways to grow—like cutting carbon, supporting communities, or building trust with stakeholders.

Climate Adaptability

We work closely with your organizations to craft climate-resilient strategies that generate sustainable value. By transforming business processes, innovating products, and aligning services with environmental priorities, we enable companies to excel in a climate-conscious landscape while fostering long-term growth and impact.

Corporate Governance

We empower clients to adopt a forward-thinking, sustainable approach to business. Our advisory services strengthen governance frameworks, ensuring long-term resilience and responsible decision-making.

In emerging markets, rigorous startup due diligence is vital to mitigate risks and unlock growth potential amidst economic volatility and regulatory complexity. By validating leadership strength, market fit, transparency, compliance, and exit pathways, our expert advisors help investors to invest confidently.