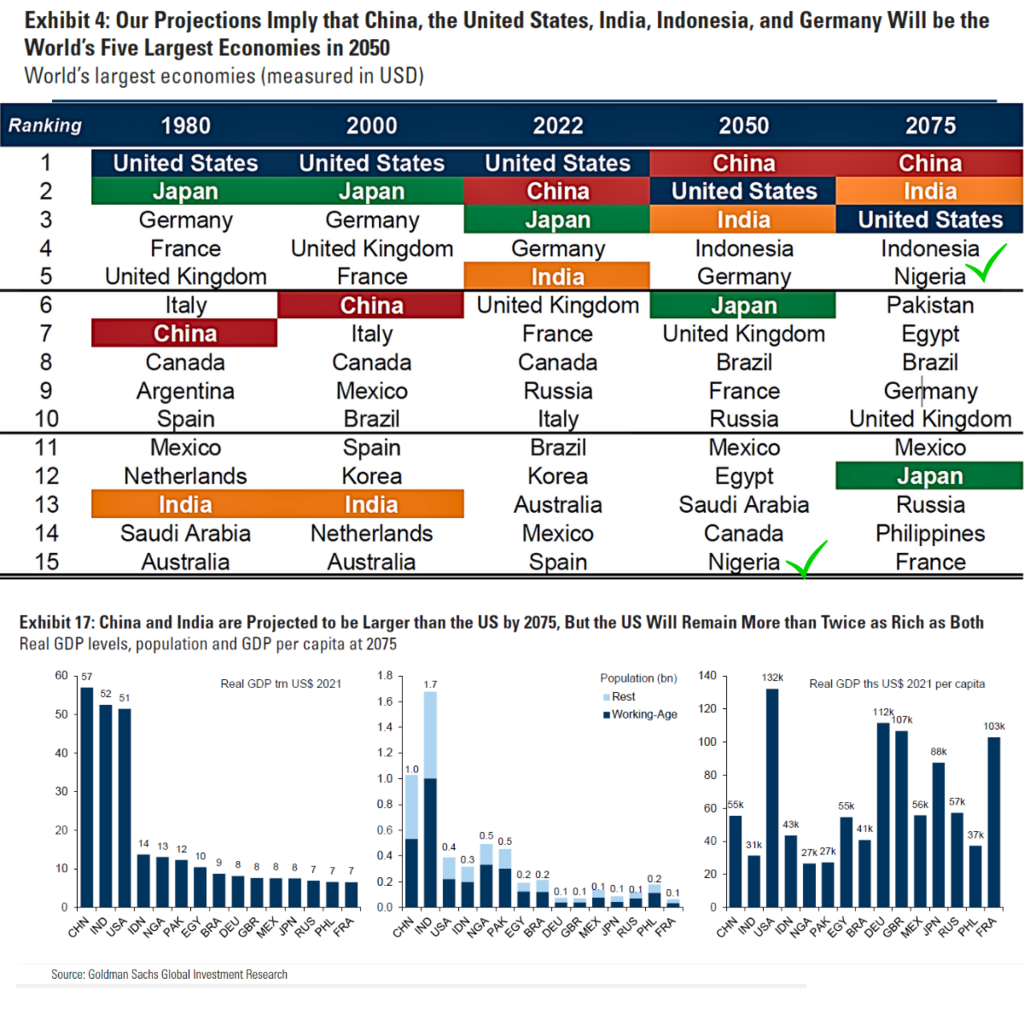

Nigeria will rank the 15th largest economy in the next 25 years, according to Goldman Sachs' projection. In another 25 years, leap to the 5th largest economy globally, growing at a steady 3.2% CAGR.

Last week, while watching and listening to the Qatar Economic Forum, one thing stood out: Qatar knows how to tell its story.

A standout moment was when the Managing Director of Singapore’s Monetary Authority praised Qatar’s infrastructure, saying even Singapore could learn from it. That caught my attention. I’ve visited Singapore three times—its infrastructure is world-class. Imagining Qatar’s infrastructure better was tough.

The key lesson for me is that, whether as a country or a private business, we need compelling, investable stories. Liquidity doesn’t chase theory. Strong fundamentals, clear strategies, and scalable operations attract capital. Hearing the Chairman of UBA Group speak about Africa's investable opportunities at the forum was impressive.

Why does this matter now?

With global investors navigating trade wars, Nigeria and other emerging markets are attractive options. Less tied to U.S. tariffs, and good bets.

What’s fueling my optimism for Nigeria?

Reforms like foreign exchange, CBN efforts at currency stability, approximately 10% growth in solar contributions to the electricity market, and a young and tech-savvy demography.

How can CFOs, CEOs, and boardroom leaders leverage tariff uncertainty to build investor confidence for our market? Here are three lessons from the Forum:

1) We must build trust with transparency. Investors accept risk but dislike confusion. CFOs should prioritize clear governance, honest reporting, and disciplined financial management.

2) Own our story. Nigerian CEOs and CFOs must boldly articulate why their businesses and industries are great investment opportunities, sharing data, vision, and tangible progress.

3) Embrace being a work in progress. Africa isn’t perfect and faces significant infrastructure challenges, and that’s why investors are curious. Frontier markets reward bold moves.

Let’s tell our story with confidence and truthfully, too. The future isn’t coming. We’re building it.

LinkedIn: https://www.linkedin.com/posts/abiodunmamora2013_investment-finance-growth-activity-7333039971110490112-4XQ3?utm_source=share&utm_medium=member_desktop&rcm=ACoAAAb-m6ABrjtIdv8Cu8W0UBQLCeOKGuq4Fq8

Globally, infrastructure is no longer just about roads and bridges. Between 2015 and 2019,

developing countries attracted over $400 billion annually in project-finance flows, spanning

power, water, telecom, and more (UNCTAD). The trend is clear: institutional investors are

increasingly viewing infrastructure as a core, long-term asset class.

Nigeria is no exception—but the stakes are even higher as the population of GenAlpha, born from 2010, becomes more than 42% of the population.

To meet its energy transition goals alone, Nigeria will require $1.9 trillion by 2060, according to the Nigerian Economic Summit Group (NESG). But the gap doesn’t stop at energy. Nigeria’s infrastructure needs are vast and visible across student housing, hospitals, railways, electricity, water systems, data centers, telecom networks, car parks, and industrial parks.

The scale of Nigeria’s infrastructure deficit justifies a multi-trillion-dollar investment opportunity over the next few decades. What’s needed now is long-term, patient capital—and a clear path to unlock it.

CFO Journey

Unless a company has a strong career growth ladder and a culture that rewards excellence, it’s tough for a trainee to climb to the C-suite. Too often, even after five years, they’re still seen as “the new kid.”

Aspiring to the top isn’t enough, one has to fight complacency and aim higher than the company’s bar. That’s how I thought when I landed my first CFO role in 2016. I knew no one’s truly irreplaceable, and companies crave fresh perspectives. Honestly, competing with yourself and renewing your perspective pays better.

Research from Korn Ferry backs this up; 63% of firms pick outside hires for C-suite roles, prizing bold, new perspectives over long tenure. Insiders can get pegged as doers, not dreamers. So, keep reinventing yourself because that’s the secret to relevance. If you aspire to be CFO or new on the role, my story of transformation might help.

Your path to C-suite might be shorter or longer, what counts is your heart and commitment. So, run your race, at your pace, and shine!

Policy – sustaining reform momentum to boost market confidence

Tech – harnessing digitization and ICT growth

People – capitalizing on youthful demographics

This triad underscores that lasting impact requires aligned government action, private‑sector innovation, and human‑capital development .

In sum, we have a cautiously optimistic view: Nigeria’s economy has the ingredients—a youthful population, flourishing tech sector, and growing service base—to leapfrog traditional development paths. The real test will be inexecution: converting the promise into sustainable, inclusive growth.